Starting a new business can be an exciting and challenging endeavor but as a new business owner in Australia, you will have many things to consider, including finding business insurance with suitable coverage. To help you on your journey, we have compiled a checklist of coverage based on your general business needs and how insurance can protect your business.

- Insurance for Liability

- Insurance for Properties and Assets

- Insurance for Finances

Liability Insurance

Cyber Liability Insurance

We live in a digital age with growing cyber threats. So Cyber Liability Insurance is becoming increasingly important, especially for businesses that store sensitive customer data or rely on technology and online platforms for their operations. The level of security may differ, but generally, Cyber Liability Insurance provides coverage for data breaches, cyber-attacks, and other online threats like hacking or data theft that can impact your business.

Public Liability Insurance

If your business interacts with or works with the public, one major insurance you’ll need is Public Liability Insurance. It provides coverage for claims against your business from property damage or third-party personal injury caused by your operations. This can be from activities at the workplace or at another location. Public liability insurance helps protect you from potential lawsuits.

Product Liability Insurance

Similar to Public Liability Insurance, product liability provides coverage for claims of property damage or third-party personal injury. The difference is instead of being a result of operations, product liability covers claims made against the products you sell or supply.

Professional Indemnity Insurance

When you provide services or advice to customers, Professional Indemnity Insurance protects your business from claims of negligence or errors and omissions in your services.

Insurance for Properties and Assets

Commercial Property Insurance

Whether small or big business, Commercial Property Insurance is essential regardless of your industry. It covers any properties or assets used for your business operations, including infrastructure, equipment, and inventory against damage or loss due to fire, theft, vandalism, or natural disasters.

Investing in property insurance is not just about compliance or managing risk but also about ensuring the continuity and resilience of your business. By protecting your physical assets, you can mitigate the impact of unforeseen events, keeping your operations running smoothly and speeding up recovery after adverse situations.

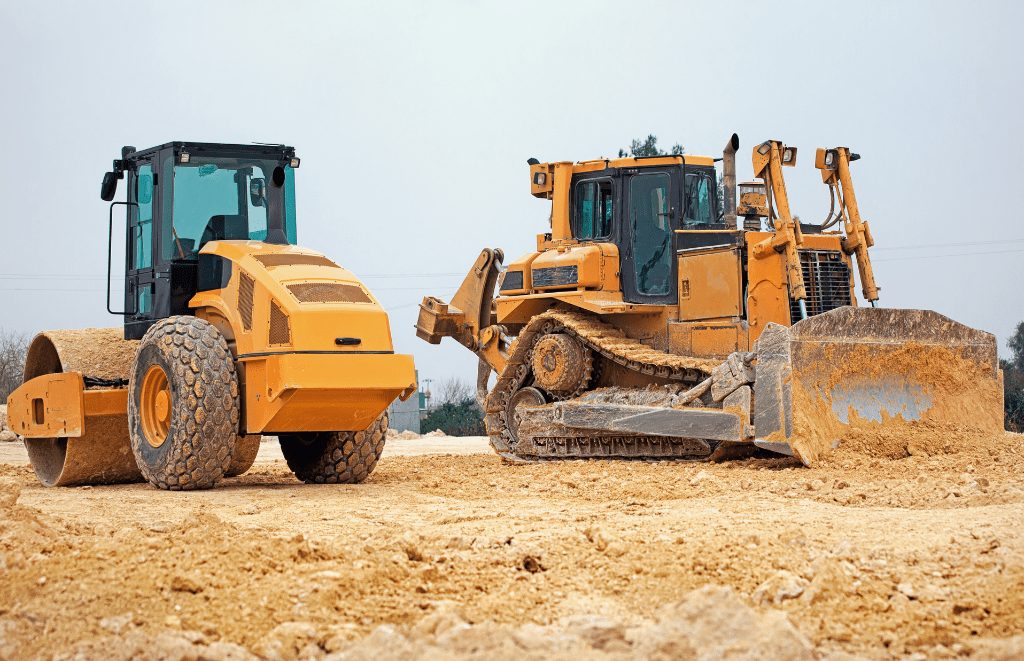

Equipment Breakdown Insurance

You’ll want Equipment Breakdown Insurance if your business relies on machines or technological equipment. This is not typically included in standard Commercial Property Insurance but is essential for businesses in manufacturing, technology, restaurants, and any other niche that heavily depends on functional equipment.

Equipment Breakdown Insurance can cover the repair or replacement costs of equipment that breaks down unexpectedly due to causes like motor burnout, power surges, or mechanical malfunctions. Beyond covering physical damage, it often addresses business losses incurred from equipment downtime, such as lost income and extra expenses needed to expedite repairs or procure temporary replacements.

Flood Insurance

Flood Insurance may only sometimes be included in Commercial Property Insurance. However, it is still a must-have, mainly if you operate in areas prone to flooding or work in an industry where the threat of flooding can derail business operations.

Finance Insurance

Business Interruption Insurance

When business operations are disrupted, whether by fire or weather conditions, Business Interruption Insurance can help you remain financially stable by covering the loss of income and even unforeseen expenses.

Credit Insurance

Credit Insurance is a risk management tool that helps businesses protect themselves from potential losses if their customers are unable to pay their debts. It’s particularly useful for businesses offering credit to customers, providing confidence when entering new markets or dealing with larger accounts. This insurance also helps companies manage credit risk effectively and optimize credit and collection procedures, safeguarding their financial health.

Workers’ Compensation Insurance

Workers’ Compensation Insurance is a mandatory insurance policy for businesses in Australia aimed at protecting employees if they become ill or injured due to their work. This type of insurance provides coverage for wages lost during the time off work, medical expenses, and rehabilitation costs needed to help the worker return to work.

The requirements and implementation of Workers’ Compensation Insurance can vary considerably across different states and territories in Australia. Differing regulatory bodies also manage worker’s compensation schemes. The State Insurance Regulatory Authority (SIRA) regulates those based in New South Wales, but WorkSafe Victoria manages insurance in Victoria.

So, before you work on finding business insurance for Workers’ Compensation, check your local regulatory office to ensure compliance.

Get your business insured

Finding business insurance doesn’t have to be complicated or stressful. At East West Insurance Brokers, we specialise in simplifying the process, helping you find the insurance coverage that best fits your business needs. Whether you’re just starting or looking to enhance your current policies, our team of dedicated Insurance Advisors is here to guide you every step of the way.

Don’t let uncertainties slow you or your business down. We’re here to help you secure your business’s future. Contact us today and get insured.