When arranging insurance for a commercial property, many owners make a common mistake: using the purchase price as the sum insured.

On the surface, it feels logical. If that’s what you paid for the property, surely that’s what it’s worth? However, the purchase price doesn’t always reflect the actual cost of rebuilding.

Purchase Price vs. Rebuild Value

It’s important to understand the difference between the purchase price and rebuild value when it comes time to insuring your property. Yes, both relate to what your property is worth, but they represent and serve very different things.

Purchase Price

The purchase price of a property represents the total amount paid to acquire it on the market. It’s affected by several factors, which include:

- The value of the land.

- The property’s location and market demand.

- Broader economic conditions at the time of purchase.

None of these is relevant to an insurer if your building is damaged or destroyed. Insurance is about replacing the structure itself, not the land it sits on.

Rebuild Value

The sum insured is generally expected to reflect the full replacement value of the building, which includes:

- Demolition and debris removal.

- Professional fees (engineers, architects, surveyors).

- Current labour and material costs.

- Compliance upgrades (to meet today’s building codes).

What’s the difference?

The key difference between purchase price and rebuild value lies in what each represents. The purchase price reflects the property’s market value, including the land, location, and broader economic factors, while the rebuild value focuses solely on the cost to reconstruct the building if it were damaged or destroyed. This includes demolition, debris removal, professional fees, materials, labour, and any upgrades needed to meet current building codes. In short, insurance covers the cost to rebuild, not the market price you paid.

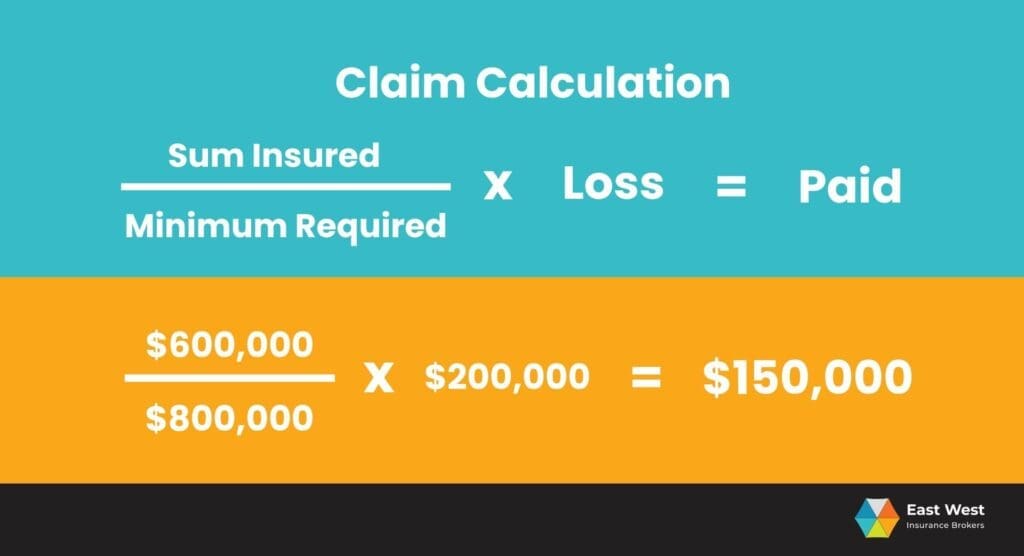

The cost of getting it wrong

If your sum insured is based on the purchase price rather than a professional valuation, you risk being underinsured. And underinsurance doesn’t just affect you in the event of a total loss. It can also reduce your payout even in the case of a partial claim. For example:

- A property was purchased for $2 million, but the actual rebuild cost is $3 million

- The sum insured is set at $2 million (instead of $3 million).

- A fire causes $600,000 worth of damage

- Because the building was underinsured by one-third, the insurer may pay only two-thirds of the claim (about $400,000)

This could leave you, the owner, with $200,000 out of pocket expenses even though the damage wasn’t a total loss.

Why professional property valuations matter

Construction costs in Australia have surged in recent years, driven by shortages of materials and skilled labour. Without a proper valuation, it’s easy to underestimate the cost of rebuilding today compared to when you purchased the property. A professional building valuation gives you:

- Confidence that your sums insured are accurate

- Protection from co-insurance penalties

- Peace of mind that your biggest asset is covered correctly

It’s best to arrange a professional building valuation every few years and review your insurance sums annually. That way, your cover keeps pace with any changes to your property, as well as rising rebuild costs and inflation.

Avoid underinsurance with proper valuation

The purchase price reflects market conditions, not rebuilding costs. Having a commercial property is already a significant investment, and underinsurance can create unexpected financial strain during claims. To safeguard your investment, arrange a professional building valuation and review it regularly. That way, your insurance truly reflects today’s replacement costs, not yesterday’s market value.

When it comes to protecting your assets and ensuring the sums are properly accounted for, a Broker would be a huge help. If you want advice or are interested in learning about available options for commercial property coverage, reach out to East West Insurance Brokers today.